The stock market is full of surprises, hidden opportunities, and shocking facts. Whether you’re a seasoned investor or a curious beginner, here are 15 unbelievable things you never knew about the stock market.

1. The Stock Market Dates Back Over 400 Years

The first official stock exchange was the Amsterdam Stock Exchange, established in 1602 by the Dutch East India Company. This marked the beginning of modern trading.

2. The Shortest Stock Market Crash Lasted Just 36 Minutes

In 2010, the “Flash Crash” saw the Dow Jones Industrial Average plummet nearly 1,000 points within minutes due to algorithmic trading, only to recover shortly after.

3. Warren Buffett Bought His First Stock at Age 11

Legendary investor Warren Buffett started young, purchasing his first stock at just 11 years old. Today, he is one of the richest men in the world.

4. The U.S. Stock Market is Worth Over $40 Trillion

The total market capitalization of U.S. stocks surpasses $40 trillion, making it the largest and most influential stock market in the world.

5. The Most Expensive Stock in the World Costs Over $500,000 per Share

Berkshire Hathaway (BRK.A) holds the record for the highest-priced stock, trading above half a million dollars per share.

6. The Stock Market Has an Average Return of About 10% Per Year

Despite volatility, historical data shows that the S&P 500 has averaged about a 10% annual return over the long term.

7. October is Known as the Most Volatile Month

While crashes have occurred in various months, October has seen some of the most significant drops, including the 1929 and 1987 crashes.

8. The Best Single-Day Gain Ever Was in 2008

On October 13, 2008, during the financial crisis, the Dow Jones surged 936 points in a single day—its largest one-day gain at the time.

9. Insider Trading is Not Always Illegal

While insider trading is usually associated with fraud, legal insider trading occurs when corporate executives buy or sell stock and properly report their transactions.

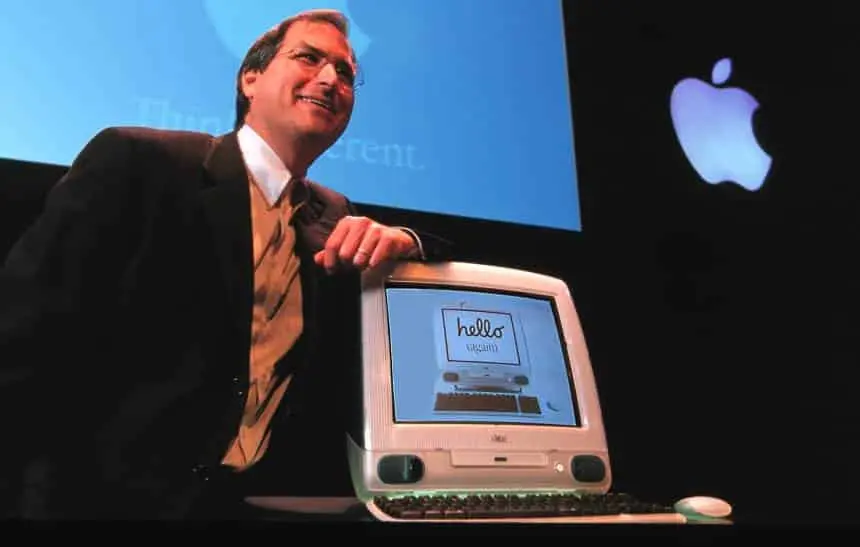

10. Apple Was Almost Bankrupt in 1997

Before becoming the tech giant it is today, Apple was on the brink of bankruptcy until Steve Jobs returned and revitalized the company.

11. There’s a Stock Market Superstition Called the “January Effect”

This theory suggests that stock prices tend to rise in January as investors reinvest year-end profits.

12. The Longest Bull Market Lasted Over a Decade

The bull market from 2009 to 2020 lasted 11 years, fueled by economic recovery and low interest rates.

13. The S&P 500 Was Created in 1957

The S&P 500 index, which tracks the 500 largest publicly traded U.S. companies, was launched in 1957 and remains one of the most important market indicators.

14. The NYSE Used to Be a Coffee House

The New York Stock Exchange (NYSE) originated from traders gathering at the Tontine Coffee House in 1792 to conduct business.

15. Fear and Greed Drive the Market

Investor psychology plays a major role in market fluctuations. Fear causes panic selling, while greed drives prices up, often leading to bubbles and crashes.

Final Thoughts

The stock market is an ever-evolving, fascinating world filled with unexpected facts and trends. Whether you’re an investor or just intrigued by finance, these unbelievable insights shed light on the dynamic nature of stock trading.

Want to learn more? Stay updated with the latest stock market trends and investment strategies by subscribing to our newsletter!

John Doe

DesignationClick here to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The biggest shifts and trends driving short- and long-term growth in the future

In a rapidly changing global landscape, certain key trends are shaping how businesses, governments, and…

Ethereum Investor Turns $151.4 Million Into $214.3 Million in Two Years Using Diamond Hands Strategy

In a testament to the power of patience and long-term investing, a cryptocurrency investor turned…

Fact Check: 12 Common Misconceptions About Stock Market

The stock market is full of myths and misconceptions that discourage people from investing. Misinformation…

See How Much $100 Invested in Bitcoin, S&P 500, and Gold in 2010 Would Be Worth Today

Investing often revolves around balancing risk and reward, and few comparisons illustrate this better than…

“The Crypto Code Review: 89% Success Rate – Myth or Reality?”

“The Crypto Code Review: 89% Success Rate – Myth or Reality?” The Crypto Code provides…

Bitcoin Has Outperformed Nearly Every Asset Class in the Past Year – Here’s Why It’s Still a Smart Investment

Over the last 12 months, Bitcoin (BTC) has outshined almost every major asset class, establishing…

The Best Cryptocurrency Investment Strategies for Beginners Hotusdeals4you: How The Crypto Code Can Maximize Your Success

The world of cryptocurrency can be exciting, but it can also be overwhelming for beginners….